How important is diversifying your investment portfolio?

Very. Especially in turbulent times like we are in now. There is no magic formula or software that guarantees results, or insider information that will net you huge profits. If you have the time horizon (6-10 Years) for investing in securities (stocks, bond, mutual funds), the best protection is to ensure your portfolio is properly diversified into the various asset classes according to your personal profile.

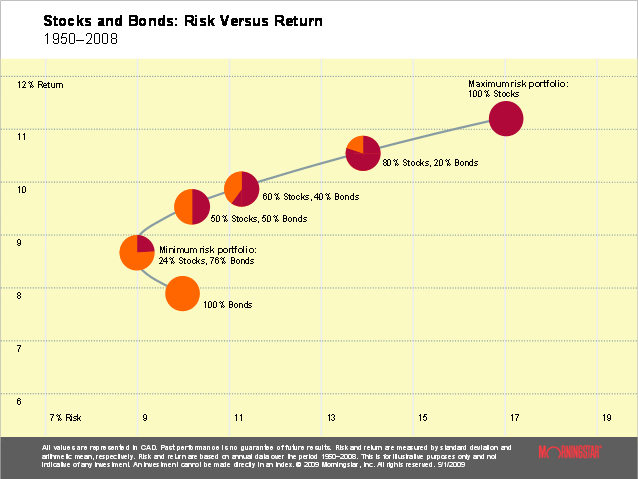

Below is a classic example provided by Morningstar, of the “Efficient Frontier” in 2 basic asset classes – check it out. Then lets meet soon to review your portfolio !

Regards, Tony

Stocks and Bonds: Risk Versus Return

An optimal portfolio is simply the mix of assets that maximizes return at each level of portfolio risk and minimizes risk at each level of portfolio return. The efficient frontier is the line that connects all optimal portfolios across all levels of risk. This image illustrates an efficient frontier for all combinations of two asset classes: stocks and bonds.

Although bonds are considered less risky than stocks, the minimum risk portfolio does not consist entirely of bonds. The reason is because stocks and bonds are not highly correlated; that is, they tend to move independently of each other. Sometimes stock returns may be up while bond returns are down, and vice versa. These offsetting movements help to reduce overall portfolio volatility (risk).

As a result, adding just a small amount of stocks to an all-bond portfolio actually reduced the overall risk of the portfolio. However, including more stocks beyond this minimum point caused both the risk and return of the portfolio to increase.

Keep in mind that diversification does not eliminate the risk of experiencing investment losses. Government bonds are guaranteed by the full faith and credit of the Canadian government as to the timely payment of principal and interest, while stocks are not guaranteed and have been more volatile than bonds.

About the data

Stocks are represented by the S&P/TSX Composite—Canadian Financial Markets Research Center for 1950–1955 and Standard and Poor’s/TSX Composite Index total return series thereafter. Bonds are represented by the DEX Long Bond Index—data from PC-Bond, a business unit of TSX, Inc. An investment cannot be made directly in an index.

Click here to book an appointment

Tony Wray

Branch Manager – Mutual Funds Life and Health Insurance Advisor 210 – 21900 Westminster Hwy. Richmond, BC V6V 0A8 Tel: 604-592-7550 ext 225Fax: 604-592-7559